FCL Shipping Explained: Costs, Benefits, and Best Practices (2025)

FCL shipping (Full Container Load) involves hiring an entire shipping container exclusively for your cargo, offering faster transit times an...

Letter of Credit (LC) is one of the most popular ways by which an importer can pay the exporter. A LC is advisable in all the cases where the exporter and importer are not known to each other, while some entities insist for it as part of their standard operating procedure (SOP).

If you are an exporter who insists on payment upfront, then your universe of possible customers shrinks, while it will terminate the risk of non-payment.

Letter of Credit (LC) is usually referred to as "Documentary Credits”. LC is an agreement wherein a bank, acting at the application of a customer (the importer or buyer), agrees to pay for goods or services to a third party (the exporter or beneficiary) by a particular date, subject to the presentation of documents as per contract.

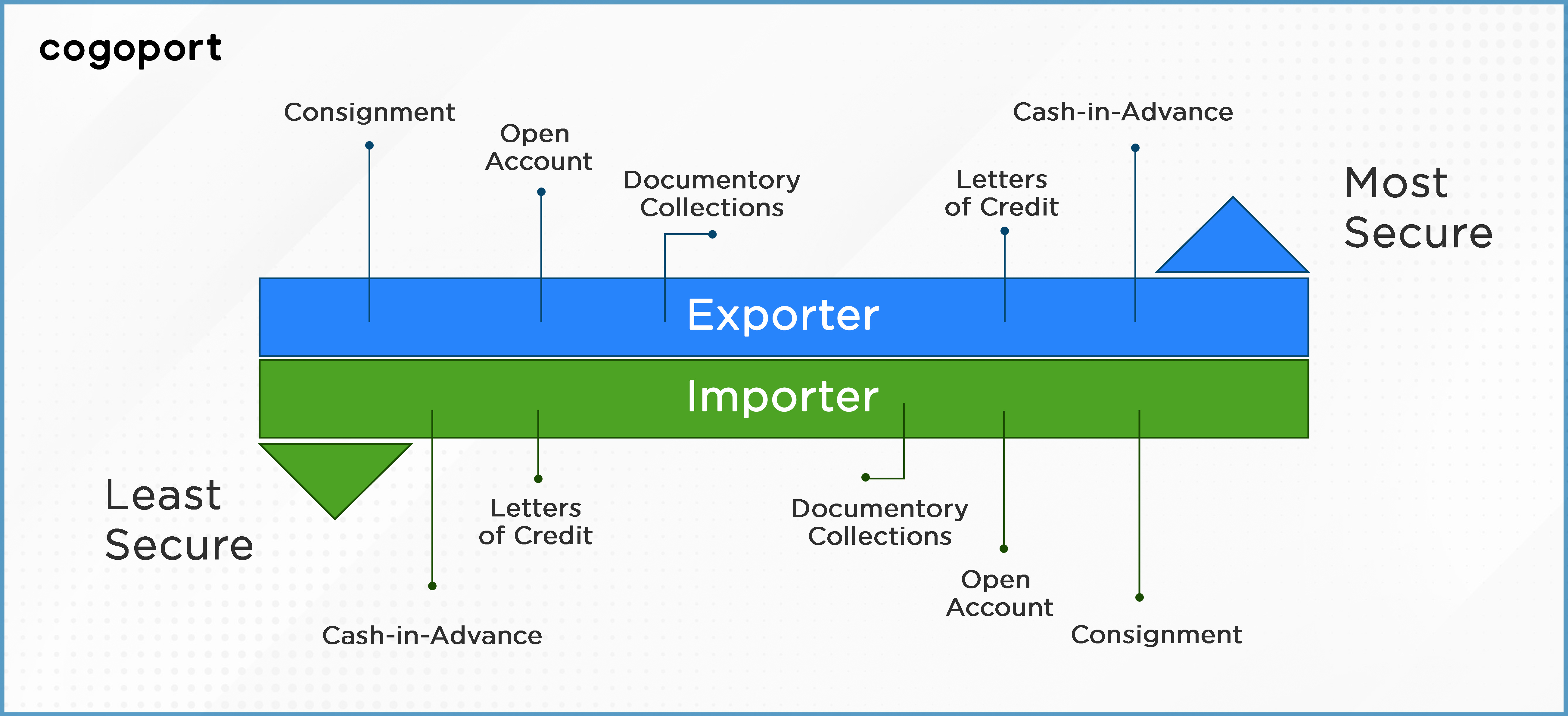

There are several ways by which an importer can pay the exporter. What may be a safe mode of payment for the exporter can easily be a risky option for importer, and vice versa. From the perspective of the exporter, receiving an advance is the safest option, while this is not popular with importers. For the sake of expanding trade and commerce, a balance between importer and exporter risk perception must be struck.

Using a LC to settle a cross border trade is beneficial for both the exporter and importer. Once certain conditions of the sale agreement are met, a LC guarantees payment from a buyer to seller. It is important for an exporter to get the whole amount paid on time.

Businesses avail credit to expand their operations. Not settling the outstanding amount when it is due can attract penalty and interest. For an importer, getting a LC is the easiest way to prove creditworthiness to an exporter.

As a buyer, it is vital to conserve cash flow and letter of credit helps to achieve this objective. Payment to seller is processed when evidence of shipment is shared with the importer. Simultaneously, a LC from an importer establishes instant credibility with the exporter and its banker.

Exporter is the beneficiary of a LC. The LC acts as an insurance for the seller. In case the importer fails to pay for the consignment or does not pay on time, the seller can invoke the LC. Once the delivery conditions are met, the LC protects against legal risks. LCs can also be pledged as security for working capital loan; this helps to complete the order.

In general, the following eight steps are involved in a letter of credit:

Step 1: The importer contacts their bank (issuing bank) for creation of a LC.

Step 2: As banks are now involved in this procedure, the nominated bank will share the letter of credit with the exporter while assuring them that the money would be received.

Step 3: The products will now be sent to the freight forwarder and the exporter will receive the Bill of Lading (BL).

Step 4: In this step goods are shipped by the freight forwarder and the exporter will share the necessary documents with the nominated bank.

Step 5: Subsequently, the nominated bank shall forward the sale related documents to the issuing bank.

Step 6: The issuing bank will debit the account of the importer.

Step 7: Documents related to the sale are released and the importer claims the goods.

Step 8: Finally, the nominated bank claims the payment from the issuing bank and releases it to the exporter.

The most important aspect of a sale for the seller is getting paid for the goods sold. When it comes to international trade, the degree of risk increases due to cross border financial risk. Using a financial instrument like the LC is a win-win situation for all the entities involved in cross border commerce.